2024’s Surprises Shaping 2025

Looking Back on 2024’s Economic Resilience and Examining Key Economic Factors for 2025

BY MICHAEL ABBOUD, CFA®

Executive Vice President & Chief Investment Officer

As we turn the calendar to a new year, we generally flip back through the previous year for guidance on what the next 12 months will bring and potential surprises to monitor. Roughly a year ago, with the S&P 500 ending 2023 at 4,770 (having returned 26% for the year), the average strategist year-end target for 2024 was 4,867, or just 2% higher.

With the S&P 500 having returned 25% in 2024, these forecasts proved wildly inaccurate. The U.S. economy “broke the rules” of the usual recessionary signals to produce above-trend economic growth, and the stock market rallied, fueled primarily by Fed rate cuts, the impact of artificial intelligence (AI), and the presidential election outcome. The past year was a stark reminder that even the most sophisticated models can be blindsided by unforeseen events.

What 2024 Says About 2025

Forecasters’ consensus calls for 2024 to see below-trend economic growth and below-average equity returns were based on trying to overlay a typical business cycle on incoming U.S. data. Traditional recessionary signals indicating an economic slowdown due to tighter financial conditions aimed at bringing down inflation proved misleading.

Consensus forecasts were proven wrong as the year unfolded because the U.S. economy was not on a traditional business cycle path. The main forces behind this historically divergent path were the rise of AI, loosening financial conditions, increased immigration, and the ongoing U.S. budget deficit. The collective impact of these forces served to support disinflation while maintaining above-trend economic growth and above-average stock returns.

These forces are essential to remember in the coming year as they will continue to exert influence and, in doing so, help support the case for continued above-trend economic growth and positive returns on both sides of the fence for stocks and bonds.

What Lies Ahead for 2025

The U.S. economy’s rule-breaking expansion looks set to continue into 2025 as many of the aforementioned forces that shaped the economy and markets last year remain in place. Despite the support of these forces, the main concern for the markets at this point might be complacency. The S&P 500 is currently trading at price-to-earnings levels that were only exceeded in the post-war era during the late 1990s. Considering this, it is hard to view the U.S. stock market as inexpensive and that much good news is not already priced in, with S&P 500 earnings growth forecast to expand 15% on top of record profit margins for 2025.

Based on this earnings outlook and current valuations, the consensus year-end target for 2025 of 6,780 for the S&P 500 would equate to approximately a 15% advance in stocks from the 2024 close of 5,881.

The absence of volatility is an additional concern, as the S&P 500 has turned in a lengthy period of low volatility, closing in on 300 days without a 10% correction versus the median of just 66 days.

However, the current high valuation and low volatility environment should continue into the new year as the U.S. economy expands with cooling inflation, the Fed continues with nonrecessionary rate cuts, consumer spending remains resilient, and policies that help corporate earnings are enacted.

Despite this positive backdrop, investors should not lose sight of the fact that the most significant changes in asset prices tend to be driven by surprises.

Here are some potential surprises worth monitoring through 2025:

Second Inflationary Wave

Though inflation has slowed meaningfully from the 2022 peak of 9%, history suggests a second wave often follows the first, with a lull of several years in between. Core inflation for the consumer price index (CPI) and personal consumption expenditures (PCE) remain “sticky” at around 3% and stopped falling meaningfully in the second half of 2024.

Reflecting on a strong jobs market and record consumer wealth, inflation related to services and housing has remained persistent.

Additionally, the Trump administration’s proposed imposition of further tariffs and supply chain deglobalization pose challenges to returning to a stable inflationary environment.

It is unclear where the impetus for softer inflation will emerge without a more extensive economic slowdown.

U.S. Deficit Becomes a Bigger Concern

With U.S. government debt relative to the gross domestic product (GDP) having tripled over the past two decades, the U.S. is currently running an unprecedented peacetime fiscal deficit of 7% of GDP.

The Congressional Budget Office (CBO) projects publicly held debt to increase from $26 trillion at the end of 2023 to $48 trillion at the end of 2034, or about a 19% increase to 116% of GDP.

Additionally, if the 2017 Tax Cuts and Jobs Act tax cuts are extended, the CBO’s estimate over the next decade would increase by $4.6 trillion.

“Bond vigilantes” may react unfavorably in 2025 if the incoming government enacts policies that exacerbate the fiscal outlook through demands for higher bond yields, which would place pressure on equity markets.

Animal Spirits vs. Reality

Popularized by the economist John Maynard Keynes, the term “animal spirits” in this context refers to the emotional and psychological elements that affect one’s economic decision-making.

The release of animal spirits in the wake of Donald Trump’s election win can be seen in the $130 billion of inflows into U.S. equity funds in the five weeks after the election (ranking in the 100th percentile relative to history), the S&P 500 rallying 5% in the same period, or the NFIB small business optimism index having its largest monthly surge in November in the series’ 50-year history.

With so much good news baked into market expectations, the risk is that the markets may not meet current lofty investor expectations and are more susceptible to a correction.

Why the Current Bull Market Should Continue

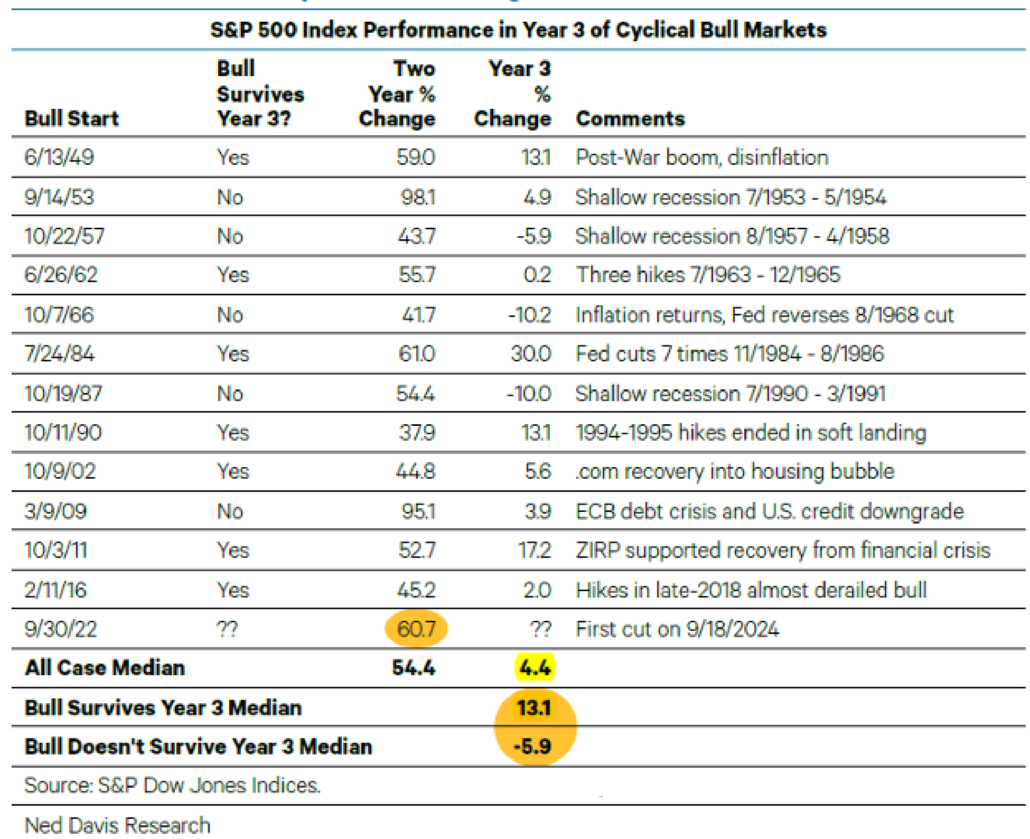

With the current cyclical bull market reaching its second anniversary last October, this occasion presents the opportunity to compare the current bull market to prior such markets and assess if it could continue into year three.

Among the 12 prior post-war cyclical bulls that lasted two years, seven have continued into year three, and the current bull market’s two-year return of 60% is in line with the median return of 54% over the first two years for a bull market (see accompanying chart). With the bull market drivers of AI adoption, disinflation, strong earnings growth, and a likely soft-landing economic outcome, the current bull market should have the fuel it needs to survive into year three. As the accompanying table shows, absent a Fed policy error, external shocks, or a hard landing, the path of least resistance is most likely a continuation of the bull market.

The median return of just over 13% for bull markets that survive year three, the 10% consensus return forecast for 2025, and the 9% median historical return during the first year of presidential terms combine to paint a picture that the coming year will be a positive one for stocks but relatively muted compared to the prior two years of +25% returns.

With favorable underlying economic conditions and continued positive investor sentiment, stocks should gain in the coming year. Though valuation complacency is a concern, stocks outside of the top 10 largest companies in the S&P 500 are more reasonably valued and should increasingly support returns in 2025 as their earnings growth closes the gap with that of the top 10 companies, which have driven the majority of returns over the past few years.

MICHAEL ABBOUD, CFA®

Executive Vice President & Chief Investment Officer

(918) 744-0553