Cautiously Optimistic

By James F. Arens II

Money managers are supposed to be cautiously optimistic over time. If we’re not optimistic, we risk becoming “perma-bears” – investors who don’t invest in the market because they’re always fearful. On the other hand, if we’re not cautious, at some point in the economic cycle we will wish that we had been a perma-bear.

In reality, cautious optimism is likely the appropriate state of mind 80% of the time since the market historically goes up three out of every four years. And, 10% of the time, when the economy and markets appear to be in dire straits and the majority of investors are scared, we need to be aggressively optimistic. The remaining 10%, when there is far too much optimism in the market, we need to embrace the cautious component of cautiously optimistic. Warren Buffet summarized it best: investors should “buy when others are fearful and sell when others are greedy.”

So, where are we now? Since the market bottomed on March 9, 2009, stocks have increased by almost 380%. The only bull market that had a greater run was the technology bubble in the late 1990s. That’s a scary comparison, but not one that’s altogether fair. The current rally started after a deep recession that lowered stock prices by more than 50%, giving stocks plenty of room to run. At this point, it feels as if we are on the border between cautiously optimistic and cautious. With that in mind, let’s examine how the markets are performing.

BOND MARKET

The Barclays Intermediate Bond Index increased by approximately 3% for the year, a fair return in what continues to be a low-interest-rate environment. Bond returns are a combination of interest income and price changes. Bond coupon rates remain low and prices haven’t changed much in 2017. Of course, we all want to know when interest rates will increase. That is why credit markets pay close attention to the actions of the Federal Reserve (Fed).

Currently, the Fed is making progress in its rate tightening cycle, having raised rates three times in 2017. The market is predicting the Fed will increase rates two to three times in 2018. Most analysts agree that the Fed would like to raise rates at a faster pace.

However, it appears the Fed doesn’t want to raise rates too quickly and risk slowing down economic growth that has been trending, until recently, at a pace of only 2 to 2.5% per year.

The Fed is also very sensitive to the fact that most major countries aren’t raising their interest rates. Each time the Fed raises rates and other countries don’t, the dollar strengthens, which hurts the competitiveness of U.S. company exports (since a strengthening dollar increases the price of U.S. products sold overseas). As a result, we believe the willingness of foreign countries to raise their rates will influence how aggressively the Fed raises our rates over time.

Given our forecast for below-average interest rates over the near term, we expect bonds will continue to generate below-average returns over the next several years. While our outlook for below-average bond returns over the near term is disappointing, the only way bond returns can get back to their historical 4 to 6% annualized returns is for interest rates to increase over time. Although painful in the short term, we should view increasing rates as a necessary step toward a normalized interest rate environment.

Interestingly, when the Fed raises rates, they only directly impact the short end of the yield curve. As the Fed increased rates over the last year, the two-year Treasury yield increased from as low as 1.1% to 1.8%.

Longer-term yields tend to reflect investor outlook for future economic growth and inflation. Despite the fact that the Fed raised short-term rates, the 10-year Treasury yield actually decreased last year, from as high as 2.6% to as low as 2.0%.

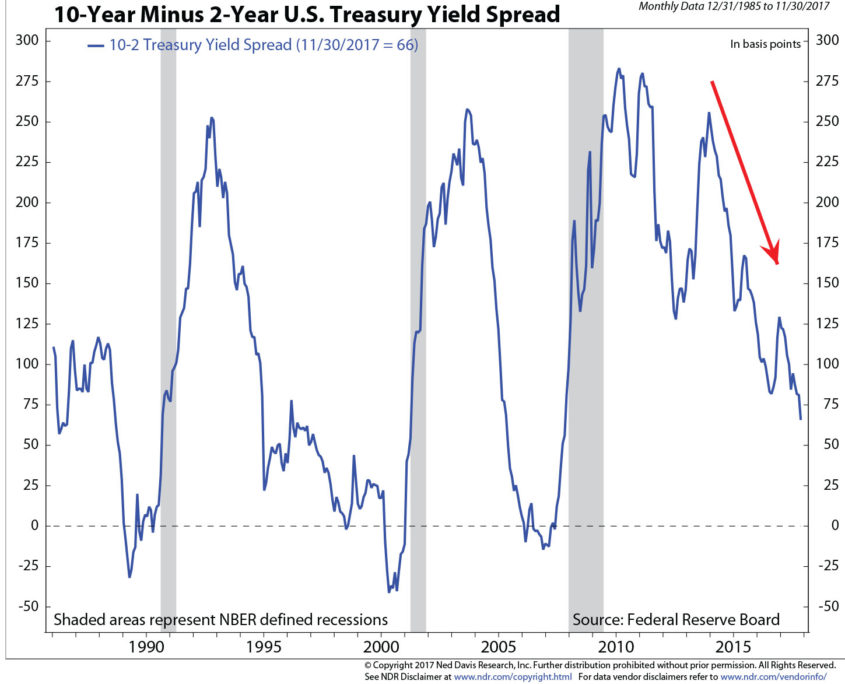

The fact that we saw short-term rates rising and longer-term rates declining explains why we have seen a flattening of the yield curve. One measure of the steepness of the yield curve is the difference between the 10-year and two-year Treasury yields (i.e. the 10-2 spread).

When the 10-2 spread tightens, it signals the economy may be softening. At the end of November 2017, the 10-2 spread was approximately .70% (70 basis points) with the 10-year Treasury yielding 2.4% and the two-year Treasury yielding 1.7%.

As you can see from the chart below, historically, anytime the 10-2 spread has gone negative by more than 10 basis points (i.e. inverted yield curve), the U.S. economy has entered a recession 12 to 18 months later (the grey area on the chart reflects historical recessions).

As a result, the 10-2 spread is worth monitoring since the batting average of a negative 10-2 spread predicting a recession since 1987 is 100%. Fortunately, the yield curve is still upward sloping (i.e. positive 10-2 spread), meaning longer-term rates are currently higher than short-term rates.

STOCK MARKET

The stock market continued its great run in 2017, up 28% since the presidential election, and up 16% per year over the last five years. As we move closer to full employment and the Fed continues to raise rates, we are exercising caution due to our belief that we’re likely in the later innings of this business cycle.

In 2017, the market moved higher primarily due to higher earnings and investor willingness to pay more for a dollar of earnings. Earnings increased 18% in 2017 and are expected to increase 16% in 2018.

While earnings have caused more of a market increase than the increase in the multiple that investors are willing to pay for earnings, we are starting to see rampant speculation in risky markets that concerns us. For example, at its high in 2017, Bitcoin increased 1,900% for the year!

While it’s fun to talk about, Bitcoin is not an “investment” that we recommend. Bitcoin has no intrinsic value and is only worth what the next person is willing to pay. Beyond that, there is significant risk that a more popular digital currency comes along that could cause the value of Bitcoins to fall out of favor with investors. In my opinion, this is a high stakes game of musical chairs. We’ll see who’s the last man standing.

TAX REFORM

The recently passed tax cuts should help stimulate the market over the next several years. Historically, the market has reacted favorably to tax cuts over the near term, averaging a gain of more than 10% in the 10 months following a tax cut. Fortunately, this tax-reform package includes both corporate and personal tax cuts.

The corporate tax cuts should improve the profitability of American companies and will hopefully stem the tide of U.S. companies relocating overseas to save taxes. Companies with significant cash on their balance sheets stored overseas will receive favorable tax treatment if they transfer the cash back to the United States. Hopefully, this incremental cash will be used to increase capital spending, hire employees and pay down debt over time.

As it relates to individual tax cuts, most Americans will benefit from the proposed tax cuts, admittedly some more than others. The hope is that tax cuts for the average American will increase consumer discretionary spending, which should benefit the U.S. economy over time. This tax reform package is front loaded with many of the individual tax cuts expiring after 2025. These individual tax cuts may help extend this market cycle, which was likely in its final innings, without the implementation of the tax bill.

In closing, 2017 was another great year in the market. Earnings should continue to rise in 2018 as a result of tax cuts, low interest rates and overall economic strength. As this bull market nears the all-time record for longest in history, we recognize that the time for caution is coming soon.

James F. Arens II

President & Chief Investment Officer

(918) 744-0553

jarens@trustok.com