Is Fiscal Discipline Extinct? – Bob’s Market Observations

Folks,

This note introduces a topic I will explore in more detail next month.

Fiscal conservatism looks to be on the wane. Entering the 2020 election, most politicians seems to be coalescing around one of two options (which they largely won’t admit to):

- Wring all available hands over the current fiscal situation. Then continue to spend and run up the federal debt to increasingly higher record levels. Raising taxes is not a priority.

- No need to wring any hands. Enthusiastically spend and borrow more – a lot more. Except for more taxes on the “rich,” the absence of higher taxes is not an impediment to spending.

An important question – why is this happening?

Two easy observations from a recent Congressional Budget Office (CBO) report helps answer this question. First, our society continues to age as the percentage of the population who are 65 and older steadily climbs.

Second, this age group is receiving a larger and larger share of total federal dollars spent, leaving a smaller share of the pie for all else.

![]()

If the CBO is correct, in 10 years 50 cents of every federal dollar (excluding interest on debt) will go to senior citizens, even though they will comprise only 20% of the population. The other 50 cents will be spent on everyone and everything else – programs that directly benefit the under-65 age group plus defense and infrastructure, national parks and the National Institutes of Health, Homeland Security and environmental protection. Et cetera.

A younger person doesn’t have to be a rocket scientist to respond: “Where’s my share?”

We are now witnessing proposals that seek to both re-apportion the pie and make the pie bigger than one might think fiscally possible. These include a push for free college tuition, student loan forgiveness, a guaranteed basic income, and Medicare for all, to name just a few pie-stretching initiatives that are clearly targeting the under-65 age group.

Woe to fiscal conservatives. Are we yesterday’s news?

Next month, I will explore this topic further and what it might mean for the markets in the future. In the meantime,

Cheers,

Bob

“The whole idea of our government is this: If enough people get together and act in concert, they can take something and not pay for it.”

– P.J. O’Rourke

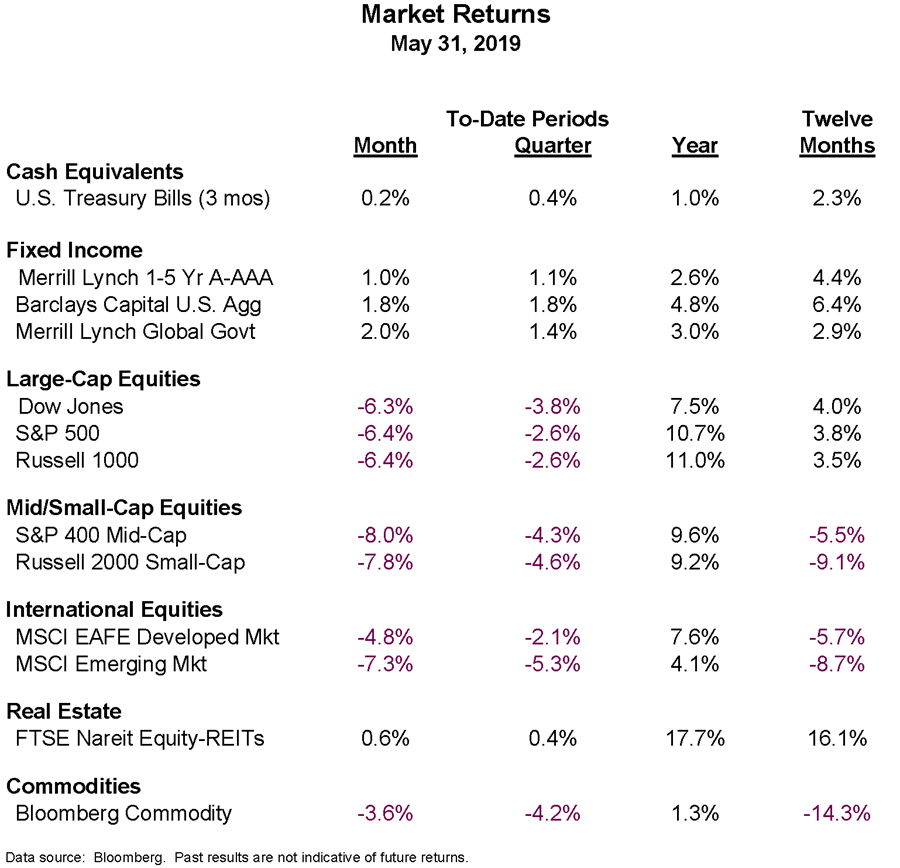

Market Returns

The stock market had a bad month. Broad indices were down 6%+ in May. The trade dispute with China heated up, making an agreement much more difficult to achieve – at least anytime soon. Then at the end of the month, the Administration surprised the markets by announcing new tariffs on imported goods from Mexico – at the same time the Administration is asking Congress to approve the recently agreed to U.S. – Mexico – Canada (USMCA) Trade Agreement. These events rattled markets.

Fixed income investments had a positive month. Interest rates fell due to the same trade concerns possibly causing the economy to slow down. Lower rates = higher bond prices. The 10-year Treasury yield is 2.1%, the lowest since September, 2017.

Robert A. McCormick

Senior Executive Vice President and COO

(918) 744-0553

Bob.McCormick@TrustOk.com