Navigating Volatile Markets

Savvy investors can find calm in the rough waters by following three steps.

BY GARRETT GUINN, CFA®

Assistant Vice President

Editor’s Note: Recent market activity has highlighted the persistent volatility we’re experiencing, a trend that underscores the importance of a well-considered investment strategy. As Garrett Guinn details in ‘Navigating Volatile Markets,’ the principles of diversification and a clear understanding of risk are paramount, regardless of short-term market fluctuations. At TCO, we remain committed to guiding our clients through these dynamic times, emphasizing a disciplined approach that prioritizes long-term stability.

Trust Company Oklahoma enjoys making market predictions based on historical relationships, asset pricing models, and solid narratives.

Still, sometimes it feels like an exercise in futility when the cards are reshuffled endlessly. Reading the tea leaves has become increasingly tricky as uncertainty rises this year because of a torrent of executive actions surrounding tariffs.

Now more than ever, we believe sticking to a proven portfolio diversification strategy with regular rebalancing will pay off for patient investors.

What’s Driving Volatility?

Volatility is embedded in nearly everything that surrounds us; whether it’s exchanges on social media or the upcoming tornado season, we’re always living with volatility. Most recently, the markets entered correction territory — or a 10% decline from its most recent peak — to start the year, a stark reminder of how rapidly the landscape can shift.

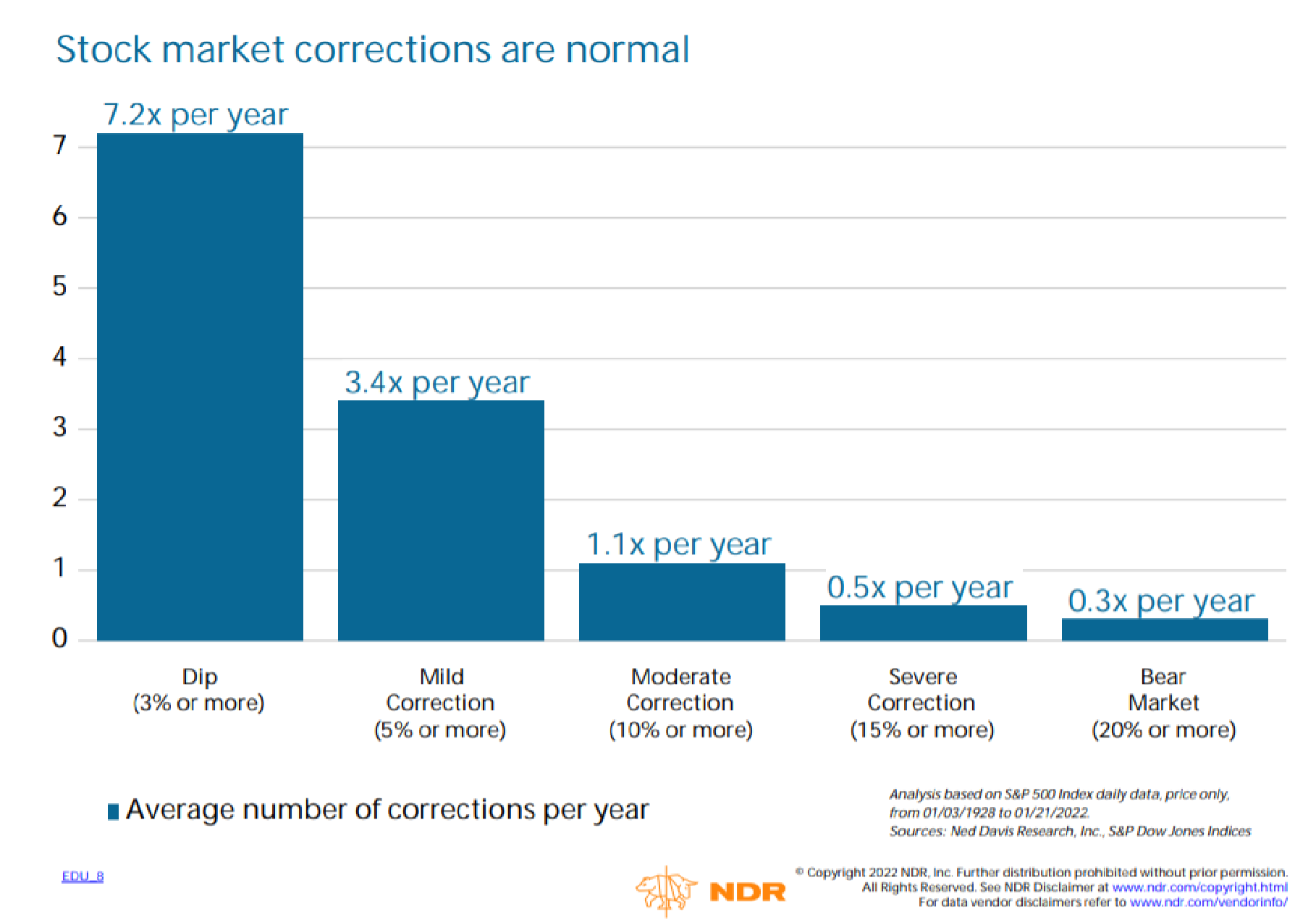

At the beginning of this year, our chief investment officer, Michael Abboud, wrote about how concerning it was that volatility was practically absent and that in 2024, the S&P 500 traded over 300 days without a 10% correction (versus the average of 173 days). For reference, in a typical year, the S&P 500 will have about one 10%+ correction. (See chart “Stock market corrections are normal” below.)

Entering 2025, we were cautiously optimistic that the bottom wouldn’t fall out and, consequently, the market would resume “normal” growth as the economy stabilized and inflation trends lowered. However, bumps in the road are part of investing, and when an asset is “priced to perfection,” you’re bound to be disappointed sooner or later.

Before the announced tariffs, the Federal Reserve had already reduced GDP growth estimates to 1.75% this year, down from 2.8% growth last year, and raised inflation expectations above the Fed’s 2.0% target. If these tariffs take effect and stay in place for a meaningful time frame, the above estimates will likely be adjusted lower and higher, respectively, as they work through the economy.

Even before the “Liberation Day” in early April, a volatile culmination of concerns over tariffs, inflation, and economic growth, as well as uncertainty about the direction of government policy, pushed several major U.S. stock indexes into correction territory. Adding fuel to the fire, the White House announced additional sweeping tariffs on 60 countries plus a 10% base tariff on all imports not covered under the U.S.-Mexico-Canada Agreement (USMCA). These developments are particularly alarming given the sheer magnitude of the tariffs, surpassing what most investors anticipated and reshaping global trade.

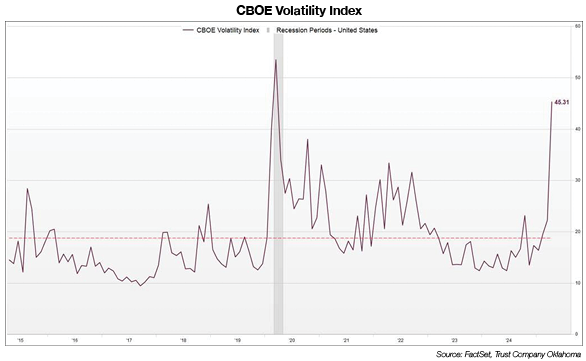

Following the April 2 tariff announcement, volatility, as measured by the CBOE Volatility Index (VIX), spiked, and the Three-Component Economic Policy Uncertainty Index reached heights not seen since the COVID-19 pandemic. (See chart “CBOE Volatility Index” below.)

As of March 31, President Donald Trump had signed 108 executive actions (73 executive orders, 23 proclamations, and 12 memorandums). He signed more executive orders in his first 10 days in office than recent presidents signed in their first 100 days. This much political movement has significantly changed the political environment, and with those changes has come market volatility.

Beyond the domestic political sphere, significant global events are also impacting market sentiment. Revelations surrounding DeepSeek’s cutting-edge advancements in artificial intelligence have led some investors to call this “AI’s Sputnik moment” as competition ramps up between the U.S. and China.

Further, the turmoil in Russia and Ukraine has far-reaching consequences that will impact both short- and long-term relations between the U.S. and other countries as they contend with persistent aggression from Russia.

So, with endless catalysts for elevated volatility, how do we navigate the choppy waters of investing?

How to Approach Risk

Understand & Accept It

Although it might be a tough pill to swallow, understanding and accepting risk are paramount to managing it. Like an insurance company, you do not have to assume all risks, but you should diligently accept the right risks.

Risk, as measured by volatility or likelihood of default, ranges from Treasury bills (considered “risk-free”) to small, private companies operating in a nascent industry (somewhat risky!).

In general, we seek to invest in high-quality securities that offer clients a reasonable rate of return on a risk-adjusted basis. In practice, we evaluate investments in risk-adjusted returns, ensuring that we receive an adequate return for every additional element of risk incurred.

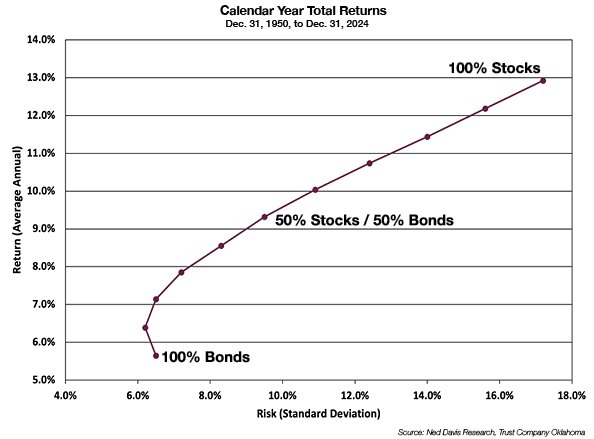

To illustrate this concept, the graph below, “Calendar Year Total Returns,” represents the “efficient frontier” and plots out risk on the x-axis and return on the y-axis. As an investor adds more stock to the portfolio, returns increase along with risk.

There’s no free lunch, and investing is an inherently risky endeavor. Risk is embedded in every asset, no matter how small, and it should be well understood before investing.

The Power of Diversification: A Shield Against Uncertainty

Diversifying your portfolio should be your top priority. The adage “don’t put all your eggs in one basket” rings true, especially when investing.

For fixed-income investing, we diversify by purchasing bonds and bond funds that are considered investment grade, mature within a short- to medium-term window, and are issued by various entities (i.e., governments, corporations, and municipalities).

We also aim to reduce equity volatility by managing exposure geographically, within economic sectors, and within market cap ranges to achieve a broad range of diversification.

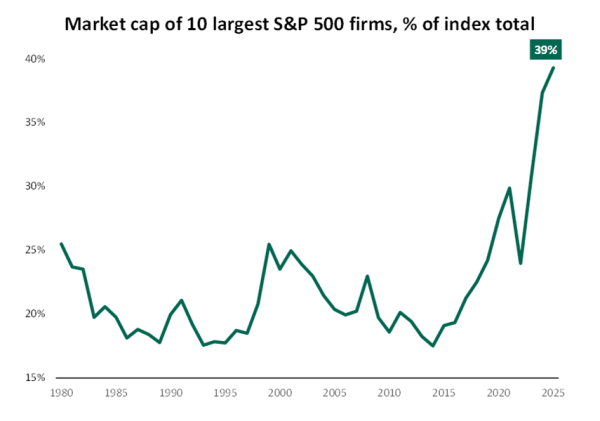

Popular indexes, such as the S&P 500, are weighted by market capitalization and offer investors a broad index of the largest public companies in the U.S.

However, with the tech run-up over the past few years, the index has become especially concentrated (see graph “Market cap of 10 largest S&P 500 firms, % of index total” below). The 10 largest companies combined comprise nearly 40% of the index, while the remaining 490 comprise around 60%.

Today’s index is even more top-heavy than the early 2000s tech bubble, when the top 10 names accounted for approximately 30% of the S&P 500.

We are not calling for a severe recession, but when an index of 500 companies becomes so lopsided that a handful of tech companies’ fortunes determine the index’s fate, an investor should take note.

Reevaluate Your Needs: A Personalized Approach

In addition to understanding risks and diversifying your holdings within each asset class, another critical consideration is reevaluating your individual needs and investment objectives. Ask yourself:

- What exactly is my risk tolerance?

- If the market entered a bear market, would I be relatively comfortable?

- How much income will I need when I retire?

These are a few examples of questions you should consider when allocating investments across equities and fixed income.

In general, as one approaches retirement, investments gradually shift from equities to fixed income in an effort to reduce portfolio volatility (risk). However, this is overly simplistic and doesn’t consider the myriad other factors, such as spending habits, health, outside resources, etc., that will influence one’s asset allocation.

We strive to take a holistic view of each client’s financial needs and build the appropriate portfolio for the desired outcomes.

Final Thoughts: Navigating the Storm with Confidence

If you’ve ignored the news and markets, hopefully this is a helpful reminder: Investing is risky, and volatility will ebb and flow with the news cycle. We expect volatility to remain elevated in the short term as economic policies take shape.

Over the long term, it’s important to remember that market corrections are a feature, not a bug, and that progress isn’t linear. In fact, the average drawdown for the S&P 500 is around 14% per year. As of this writing, after the April 2 equity sell-off, we’ve reached a peak-to-trough decline of nearly 17% for the S&P 500 and are approaching bear market territory.

Through our lens, the economy will narrowly avoid a recession this year thanks to a resilient labor force, further monetary easing, business-friendly deregulation, and fiscal stimulus.

If too much volatility keeps you up at night, please read points one through three above and make the necessary changes so you can rest easy. Investing in the U.S. can be characterized by long summers and brief winters, but that doesn’t warrant unnecessary risk-taking.

GARRETT GUINN, CFA®

Assistant Vice President

(918) 744-0553