OUR LATEST – ESTATE PLANNING

Trusts & Insurance: Protect Your Home From Tornadoes, Fires, and Claim Denials

One omission from your homeowner's insurance policy can cost you in the event of a disaster.

April 2025 Investment Perspectives

We discuss how to handle the recent and how to protect your financial plan in the event of a natural disaster.

Estate Planning Given Extra Agility Thanks to New Oklahoma Act

Empower yourself against digital risks with practical tips to safeguard yourself and loved ones in today’s interconnected financial landscape.

January 2025 Investment Perspectives

We discuss the market in 2023 and look ahead to 2024, digital safety, and updated FDIC calculations for trust-owned bank accounts.

IRA Stretch: A Special Needs Trust Solution

Empower yourself against digital risks with practical tips to safeguard yourself and loved ones in today’s interconnected financial landscape.

October 2024 Investment Perspectives

We discuss the market in 2023 and look ahead to 2024, digital safety, and updated FDIC calculations for trust-owned bank accounts.

July 2024 Investment Perspectives

We discuss the market in 2023 and look ahead to 2024, digital safety, and updated FDIC calculations for trust-owned bank accounts.

Leave a Rich Vein, Not a Legal Drain: Estate Planning for Oil & Gas Assets

We take a look at the new rules for FDIC insurance limits for bank deposits owned by trusts. The good news: It will be simpler to calculate.

Building Trust: Choosing a Fiduciary for Peace of Mind

Empower yourself against digital risks with practical tips to safeguard yourself and loved ones in today’s interconnected financial landscape.

April 2024 Investment Perspectives

We discuss the market in 2023 and look ahead to 2024, digital safety, and updated FDIC calculations for trust-owned bank accounts.

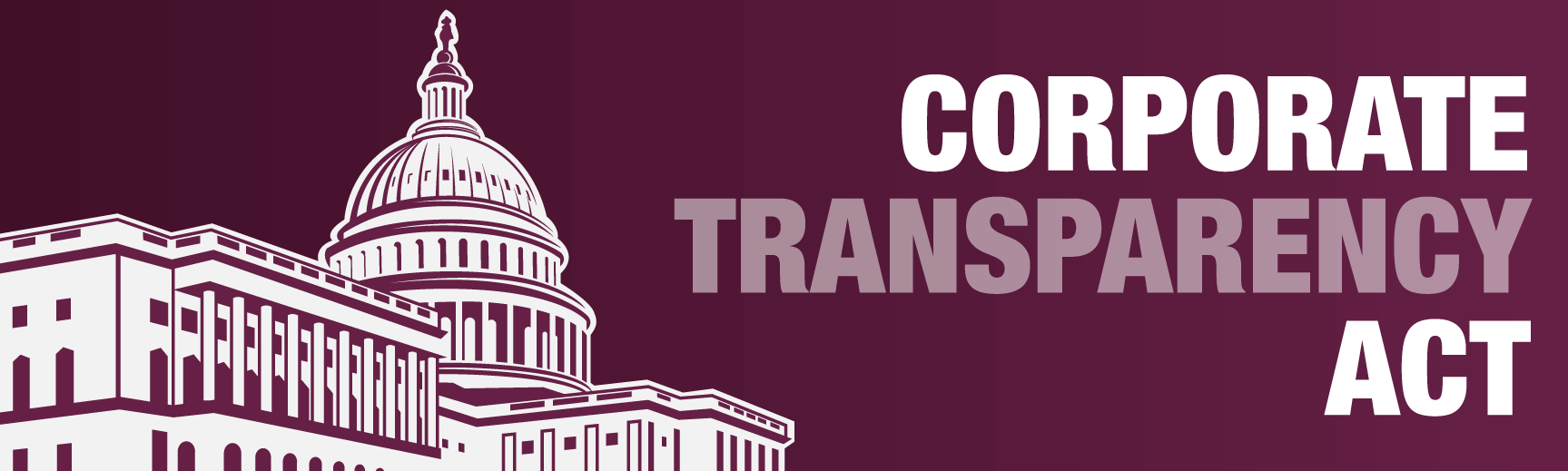

Corporate Transparency Act: New Law Requires Many Companies to Register Owner Information

We take a look at the new rules for FDIC insurance limits for bank deposits owned by trusts. The good news: It will be simpler to calculate.

January 2024 Investment Perspectives

We discuss the market in 2023 and look ahead to 2024, digital safety, and updated FDIC calculations for trust-owned bank accounts.

FDIC Insurance: Navigating New Rules for Trust-Owned Bank Deposits in 2024

We take a look at the new rules for FDIC insurance limits for bank deposits owned by trusts. The good news: It will be simpler to calculate.

October 2023 Investment Perspectives

We discuss AI and its effects on the markets, TCO updates, deferred sales trusts, and how to avoid fireworks caused by your estate plan.

July 2023 Investment Perspectives

We discuss AI and its effects on the markets, TCO updates, deferred sales trusts, and how to avoid fireworks caused by your estate plan.

When Fireworks Aren’t Fun

Taking proactive steps with your estate plan can diffuse tensions among beneficiaries.

April 2023 Investment Perspectives

We discuss the bank failures of early 2023 and how they compare to 2008, as well as key aspects of Secure Act 2.0 and real estate trends.

January 2023 Investment Perspectives

We discuss the economic outlook for 2023, whether cash is still trash, gifting to children & grandchildren, and why charitable giving doesn't have to be so stressful.

The Pitfalls of Self-Made Estate Plans

Robert Louis Stevenson’s The Strange Case of Dr. Jekyll and Mr. Hyde sheds light on why you should engage the experts before drafting your own estate plans.

April 2022 Investment Perspectives

We discuss the Fed's response to inflation, updates to our Oklahoma City office, choosing a successor trustee and dealing with your "things."

January 2022 Investment Perspectives

We discuss inflation, the market and the economy of 2021 and 2022, the 1099-B form, the difference oil & gas professionals can make, and more.

Decanting Statute Will Rewrite Oklahoma’s Trust Playbook

Much like how a game in 1912 forever changed the game of football, a new Oklahoma statute will change the way trustees can act on behalf of beneficiaries.

October 2021 Investment Perspectives

Our experts discuss how long Big Tech can keep up its big gains, Oklahoma's new decanting statute and protecting yourself from cybercriminals.

July 2021 Investment Perspectives

Our experts discuss whether inflation is here to stay and provide details on how Biden's tax plan could affect you and your assets.

Unraveling Biden’s Tax Plan

President Joe Biden's revenue proposal could affect income, capital gains and estate tax rates. Find out what changes could be coming.

ViewPoint – A Letter From the Desk of Jim Arens – July 2021

TCO is proud to celebrate 40 years of helping to protect our clients' assets, grow their wealth and advise them for life.

April 2021 Investment Perspectives

Our experts explain how Bitcoin works, what you can do to capitalize on the real estate market, and how Spousal Lifetime Access Trusts can help remove assets from your taxable estate.

Spousal Lifetime Access Trusts

The Spousal Lifetime Access Trust may be the perfect tool to shift assets out of your taxable estate.

ViewPoint – A Letter From the Desk of Jim Arens

The pandemic may have changed many things but one aspect of our business has not.

January 2021 Investment Perspectives

Our experts reflect on the economic trends likely to impact investors in 2021, preventive financial care and estate planning lessons from Walden.

The Importance of Preventive Financial Care

Its better to be safe than sorry. Make your estate planning a priority in 2021.

Through Thick And Thin

2020 was without a doubt an interesting year. Despite all the challenges, the economy rebounded sharply. What does the future have in store for 2021?

Walden, Donuts and Estate Planning

Lessons on estate planning from Thoreau's masterpiece.

A Leader’s Legacy – Saying Farewell to Tom Wilkins

Recently, Thomas W. Wilkins retired as CEO of Trust Company of Oklahoma after 30 years serving our clients. He will remain as Chairman of our Board of Directors and the values he has instilled in all of us are his strongest legacy.

It Takes a Team – The Recipe for Successful Estate Planning

Couples get better investment results when both spouses discuss their views with their financial professionals.

ViewPoint – A Letter From the Desk of Jim Arens

It is my pleasure to share with you some great news about our professional team.

October 2020 Investment Perspectives

A comprehensive overview of the stock market, the recipe for successful estate planning, saying farewell to Tom Wilkins, welcoming new professionals and more.

Hazards of Other People’s Money

Six tips to avoid mistakes and litigation when serving as individual trustee.

Estate Planning for Children Moving Out

The essential estate planning documents to ensure your new adult is legally and financially prepared for adulthood.

Whittney Stauffer Joins Friends of Finance Board of Directors

/

1 Comment

Stauffer will serve the organization during the 2020-2021 school year.

Trust Company of Oklahoma Promotes Jim Arens to Chief Executive Officer, Michael Hopper to Chief Operating Officer

Trust Company of Oklahoma Promotes Jim Arens to CEO, Michael Hopper to COO.

Protecting Your Loved Ones

Oklahoma families now have the right to install monitoring cameras in assisted living residents' rooms. This could help avoid abuse and neglect, but also provide peace of mind during lockdowns. Read Lesa Creveling's article on Tulsa World.

ViewPoint – Our Professional Team

Dealing with a worldwide pandemic, the TCO way. Read more.

Feeling More Secure After the SECURE Act

IRA and estate planning without the stretch provision.

Returning Stimulus Payments Made to Deceased Individuals

Have you received a stimulus payment made to your deceased spouse? Here is how to return it.

Adoption and Estate Planning

If you (or a family member) ever placed a child for adoption and don't want him to be an heir, you should revisit your estate planning documents.

Subzero Oil Prices and the Storage Problem

U.S. crude sold at -$37.63 a barrel on Monday, a historic drop below zero. How did we get to this point in the oil and gas industry?

What Will Your “New Normal” Look Like?

How will the COVID-19 social distancing affect your life going forward? Read.

ViewPoint – Our Offices Are Open

Our offices are open and our professionals continue to serve you. Read more.

Outlast The Storm

You can't control the stock markets nor stop COVID-19. Managing investments in the midst of the pandemic.

The End of the Stretch IRA

The SECURE Act eliminated a popular feature, the “Stretch IRA.” Learn how this will impact your estate planning and charitable contributions.

Tax Day Delayed To July 15

As COVID-19 grips the nation, the IRS delayed the deadline to file and pay federal income taxes. Read more.

Our Response To COVID-19

Our offices are open and our services continue uninterrupted. Read more.

Don’t Let Fear Paralyze You

In times of uncertainty with stock market and health concerns, it is easy to let fear paralyze us. Read Lesa Creveling's article.

Why Have TCO Serve as Your Corporate Trustee

Although you may ask a relative or a friend to be your trustee, a corporate trustee can be a wiser choice. Learn more.

Guardianship Checklist

While confronting mortality can be difficult for any parent, it's beneficial to leave your nominated guardian with a guide for raising your children in the event of your absence or incapacity. Learn more.

Planning for Addict Beneficiaries

While the topic of substance abuse in families can be difficult, it's a growing epidemic that is important to take into account when estate planning.

Phone Scam Alert

Do not fall for the Suspended Social Security Number scam.

A Beneficial New Year’s Resolution

Some resolutions are hard to accomplish. This one is easy - but very important, especially with the passage of the SECURE Act.

ViewPoint – Congratulate Our Professional Team

Let's raise a glass to the new year! We have two new officers and several professionals have been promoted.

SECURE Act Significantly Impacts Your Retirement Planning

If you have an IRA heading into 2020, here's what you need to know about the new tax law and how it may impact your retirement and estate planning.

Doing the Limbo

Our Chief Investment Officer looks back at 2019. Stock returns were very strong, but the bond market forced investors to play the limbo game.

New Year’s Resolution: Revisit Your Estate Plan

Now that the holidays are officially behind us, many of you are revisiting that final vestige of the season: the resolution list.

Be a Responsible Property Owner: Properly Store Your Documents

While record-keeping can be a tedious task, it's essential to being a responsible property owner.

Graduating From the Kids’ Table

While dividing attendees into two tables works well for a packed house during the holidays, don’t apply this philosophy to estate planning.

Understand Proposed IRA Changes Before Making Estate Planning Decisions

Changes may be on the horizon for legislation regarding Individual Retirement Accounts (IRAs). Understanding and reviewing the proposed bills is prudent before making estate planning decisions.

Chill Before Serving to Avoid Family Litigation

Litigation can be destructive to families, both financially and emotionally. Learn how families can avoid the courts to settle their differences.

ViewPoint – Great News About Our Professional Team

Summer was busy at TCO with some great achievements by our professional team and two new officers joining our firm.

Bob McCormick Hits the Open Road

Our colleague is taking an early retirement at the end of the year. Although we don't normally announce retirements in this publication, it is important to note a few of Bob's lasting impacts on us, his colleagues.

Where There’s a Will…

What do Aretha Franklin, President Abraham Lincoln and Prince have in common? Find out.

Upside Down

Making Sense of the Recent Yield Curve

How to Talk To Your Heirs About Your Estate Plan Without Ruining Your Relationship With Them

There can be big benefits to your family knowing your estate plan. But how to communicate to your heirs who gets what without spoiling the relationships with each of them?

What Does Your Family Look Like?

Family structures have become more complex over the last few decades. Most households are now the result of blended families with working moms, adopted kids, second marriages, and the list goes on. Your estate plan needs to be customized for your specific situation.

IRA: Why, When & How Often?

Here we share some important guidance on when to withdraw funds from your IRA. While withdrawal may seem like an easy task, you may find yourself paying more in taxes than necessary.

The Fiduciary Rule: What It Means For You

We have served our clients with a fiduciary duty since our founding in 1981.

Alzheimer’s And Dementia Patients Are Easy Prey For Scammers

Avoid being a victim of financial exploitation.

Don’t Be A Silo

Individual trustees do not need to face all the challenges alone.

ViewPoint – Why Clients Do Business With Us

I have many reason to be proud of who we are and the services we offer

Honey, We Forgot The Car!

How to handle cars in estate planning

Asset Distribution Per Stirpes

Understanding your will and how your assets will be divided

How Health Problems Become Wealth Problems

Effective retirement planning involves being healthy. Learn how to protect your wealth and your health after you retire.

Row, Row, Row Your Boat

Are you, your family members and professional advisors rowing in the same direction when it comes to your estate plan?

Collecting Spousal Social Security Benefits

Social Security benefits are an important component to retirement planning. Here's what you need to know about receiving Social Security on your spouse.

Staying on The Yellow Brick Road

Financial exploitation and elder abuse continue to rise. How can you protect yourself and your lifetime savings? Read Lesa's article.

Beyond Our Borders: Why You Should Be Investing in International Markets

It is important to invest in international stocks. Here's why.

DPOA: A Document With Super Powers

A Durable Power of Attorney is a super document. It allows a trusted representative to act in your place. Learn how a DPOA can help you.

ViewPoint – A Message from the Desk of Tom Wilkins

"Why should anyone hire Trust Company of Oklahoma to serve as corporate trustee and invest the assets if a family member can do it for free?" she asked me. Here's what I responded.

Playing Hoops With the IRS

Are you a small business owner or investor? Please meet Qualified Business Income (QBI) deduction.

Happy Birthday, Batman!

Batman, the first comic strip trust fund baby, turns 80 today. What lessons can we draw from the Dark Knight?

Ron Burke, CFP®, CTFA Joins Trust Company of Oklahoma

The oldest and largest independent trust company in the state is pleased to announce that Ron Burke joined the firm as a senior vice president in the Oklahoma City region.

2019 Taxes Cheat Sheet

Easily find out how much you owe the IRS on income taxes, long-term investment capital gains taxes, or trust taxes. A printable cheat sheet to keep on your desk.

Alzheimer’s and Dementia Patients Are Easy Prey For Scammers

Each day, Alzheimer's or dementia patients are at a high risk of being financially exploited. Learn how to spot it and how to prevent it.

“Drill, Baby, Drill”

The oil and gas market has been a rollercoaster. Oil barrels reached the $75 price range then dropped again. What does 2019 hold for the energy industry?

The Return of Volatility

It was a challenging year for investors. We wrapped up 2018 with a second 10% correction for the year. What's driving investor anxiety and how does 2019 look like for the markets?

Cracking The Medicare Code

What You Need To Know Before Signing Up for Medical Coverage.

It’s Not Too Late To Build A Fence When The Cows Are Out

Estate planning and asset protection are really nothing more than building and maintaining fences. A successful plan keeps the cows (assets) in and the wolves (creditors) out.

Tariffs And Raisins – Children Pick Up On The Darndest Things

The Trump administration recently imposed steep tariffs on several countries, including China. In retaliation, China imposed tariffs on American products. This isn't the first time the U.S. grapples with competitive tariffs, though. Learn more about our country's history of tariff conflicts and the current conflict's impact on our economy.

Market Observations by Bob McCormick – September 2018

The right estate planning will not only put our own minds at ease but make our family’s life less stressful.

Market Observations by Bob McCormick – August 2018

Thinking you can day-trade your way to riches by being fast is bad thinking. If you can’t outrun a cheetah, don’t even think about out-trading high-frequency trading firms.

The Certainty of Taxes in Retirement

Many retirees mistakenly believe that once they retire they won't have to pay taxes anymore. Your retirement success depends on planning carefully your income and taxes. Read article.

Market Observations – July 2018

Corporate earnings are growing at a double-digit rate, yet halfway through the year the S&P 500 posted a meager 2.6% return. Read Bob's investment market commentary.

Decrypting the Bitcoin Bubble

The cryptocurrency's meteoric rise in 2017 had the investment community in awe. Today, the Bitcoin phenomenon has turned into a bloodbath. Investors' confidence is gone. Read an interview with Senior Vice President Michael Abboud about Bitcoin's rise and fall.

Tax Reform: How It Affects You

Congress recently passed the largest piece of tax reform legislation in more than three decades. The bill affects most taxpayers. One area is the ability to deduct charitable contributions. Vice President Emily Crain broke it down to what you need to know.

Market Observations – June 2018

A lot of factors impact economic growth, and demographics are certainly one of them. The government just released the 2017 births report, and the findings show a 30-year low in the number of births and a large increase in deaths for age group 25-34. Read Bob's commentary.

Top 5 Retirement Planning Mistakes

Along with getting married and having kids, retiring is one of the most serious decisions you will make in life. If you plan carefully, your retirement years can be filled with joy and financial independence. But the alternative can lead you to serious financial problems. Here are our top 5 retirement planning mistakes to avoid in order to achieve a successful retirement.

Why You Might Want Both a Traditional 401(k) and a Roth

Planning for retirement involves balancing what you're willing to set aside now with what you'll pay in taxes while in retirement. Splitting your retirement savings between a traditional 401(k) and a Roth 401(k) — or IRA — is sound planning.

Is Estate Planning Now Dead?

Federal estate taxes may no longer be an issue. However, many states still have estate and inheritance tax. Visit with our estate planning experts to develop financial strategies beyond the consequences of the 2017 Tax Cuts.

‘Tis the Season for Elder Financial Abuse

It always seems to be the season for financial abuse and scamming of the elderly.

Overcoming The Emotion of Family Properties

Family legacy properties are extremely emotional assets. The feelings triggered by the thought of parting with the family farm, lake cabin or beach house can become the cause of tension among family members.

Retirement Income Planning: Escaping from the Daily Grind

Odds are you too have invested far more time than necessary researching some banal household purchase. But if you are nearing your retirement or are already in the midst of it, how much time have you have considered your income strategy in retirement? Was it more or less than the time spent on your last Amazon.com purchase?

The Dangers of Senior Isolation

Old age “ain’t for sissies.” There is some truth to that.

Establishing Trust, Step-By-Step

Creating a trust is a very important step in the estate planning process; but without funding the trust, there is no value to the trust document.

Roth Rules

How to Make a Roth Work for You

Whatever it Takes?

U.S. stocks were up modestly the first half of the year. The trip was anything but calm. A sharp drop early in the year was followed by a rally moving in tandem with higher oil prices.

A Better 401(k)

Learn to Love the Pullbacks

That’s What Trusts Are For

Learn to Love the Pullbacks

Learn to Love the Pullbacks

Learn to Love the Pullbacks

Dangerous Words

There are five words investors should always use with caution: "It is different this time". In this article Bob suggests two unusual suspects which may explain why "different" may be happening now.

The Real Deal?

Forget about the get rich quick schemes for a moment and read Scott’s level-headed advice about the pros and cons of owning real estate.

Planning For What Matters Most!

Will the Bull Stumble in 2014?

Making the Right Choice for What You Can’t Take With You

Will the Bull Stumble in 2014?

Don’t Let Your Digital Assets Evaporate Into the Cloud

In this article, Melissa Taylor sheds light on a subject that has never crossed the minds of many, Digital Assets & Estate Planning.

Fees Matter

In Debi Combs article, Fees Matter, she explains the importance of knowing what fees are being charged in your 401(k) plan and how those fees can effect your bottom line at retirement.

The Retirement Myth

Two popular yet contradictory mindsets in modern culture say that you should love what you do and that you should strive to stop doing it as early as possible.

The Sword of Damocles: Funding the Living Trust

Jamie O’Shields writes about unfunded living trusts and the dangers of staying in the hot seat.

Preventing Exploitation of Elders

Jennifer May discusses a topic we all hope to never experience but need to be made aware of. Elder exploitation is no joke. Learn how to arm yourself and your loved ones.

IRAs: Why, When & How Often

Karen Ellis provides important guidance on when to withdraw funds from your IRA. While withdrawal may seem like an easy task, you may find yourself paying more in taxes than necessary.

Yes, We Can!

David Stanley clears up a common misconception some individuals have when they hear the name “Trust Company of Oklahoma.”

Handling Overlooked Mineral Interests of Deceased Owners

Here in Oklahoma, families hold mineral interests, often for generations.

Family Wealth Preservation Trust

Protecting your assets from creditors may not be the first thing you think about when you wake up but all too often, people do not think about it at all until it is too late. Fortunately, in Oklahoma we have an attractive asset protection vehicle called the Oklahoma Family Wealth Preservation Trust (FWPT) that can help Oklahoma residents and non-residents alike. Read Lesa Creveling’s insightful article (originally published June 2006) on the benefits of this asset protection trust, its tax treatment and how it works in relation to federal bankruptcy law.

The Road to Trustee Hell is Paved with Good Intentions

Joanna Murphy discusses the challenges individuals face when serving as a trustee or as an executor of an estate. Being a fiduciary carries a tremendous amount of responsibility ranging from detailed record keeping to bill paying, from tax returns to investments. But don’t despair - Joanna also shares how having a corporate trustee such as Trust Company of Oklahoma can help ease the burden when filling this role, especially for friends and family.

Prosperity with a Purpose

Is there a purpose for your prosperity? In other words, what are you trying to accomplish with your wealth?

The Oil & Gas Industry in Oklahoma

Many do not realize that gasoline accounts for less than one-half of the products made from a barrel of crude in the U.S

Planning & Caring for Children with Special Needs

Parents of children with disabilities are often faced with the challenge of providing a level of care most families never experience.

What About My Retirement?

When I retire, I plan to travel to exotic places, spoil the grandkids I hope to have someday and spend lots of time on the beach. I know these dreams won’t come true without some wise decisions on my part--many of which have to do with my retirement plan.

https://www.trustok.com/wp-content/uploads/2019/01/TRUSTS-OPT-200px.jpg

200

667

vanessaf

https://www.trustok.com/wp-content/uploads/2023/05/TCO-Primary-RGB-High-Res.png

vanessaf2011-01-01 15:54:082021-02-24 12:53:21Tread Carefully in Naming a Trust as an IRA Beneficiary

https://www.trustok.com/wp-content/uploads/2019/01/TRUSTS-OPT-200px.jpg

200

667

vanessaf

https://www.trustok.com/wp-content/uploads/2023/05/TCO-Primary-RGB-High-Res.png

vanessaf2011-01-01 15:54:082021-02-24 12:53:21Tread Carefully in Naming a Trust as an IRA Beneficiary

The Unknown Certainty of Taxes

As the old saying goes, nothing in life is certain but Death and Taxes.