Qualified Charitable Distribution

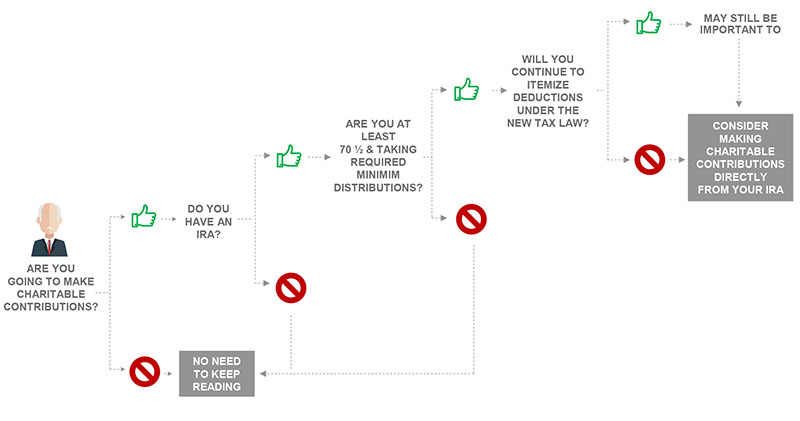

If you have an Individual Retirement Account (IRA) and are at least 70 ½ years old, you must take a Required Minimum Distribution (RMD) from the account annually. If you also give to charity, consider making those gifts from your IRA. With a Qualified Charitable Distribution (QCD), you can directly contribute your RMD amount (up to $100,000) and have it satisfy your distribution requirements.

This is an especially attractive strategy if you are no longer able to itemize deductions on your tax return. Making a QCD lowers your taxable income since it is in place of the taxable RMD to you. It may also reduce your Medicare premiums and Social Security taxes.

Visit with our financial advisors to discuss if this is a good strategy for you.