Taking Shortcuts on Retirement

By Philip Mock

Deciding when to retire is a very important financial decision. Some choose to retire later in life. Others, however, end up retiring earlier than they expected, which can dramatically affect their financial position in retirement.

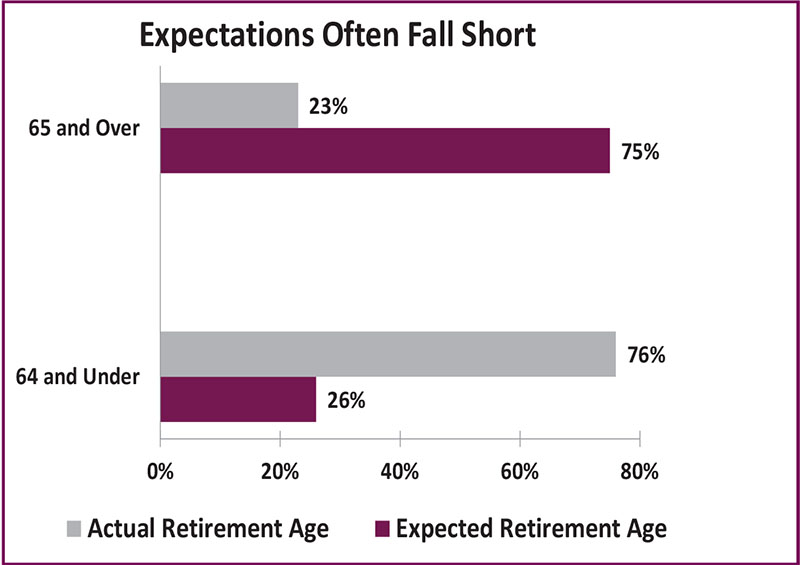

A recent Wall Street Journal article explored the differences between the actual and expected retirement ages of Americans. The article examined data collected from the Employee Benefit Research Institute. According to the research, about 75% of those polled expected to retire at 65 or later, but only 23% actually met that goal (see chart below).

It may not sound like taking a shortcut of one or two years would make a big difference, but it does.

Let’s consider a hypothetical family: Ben and Nancy. They expect “average” social security benefits, have $1 million in retirement savings with a balanced portfolio, and plan to spend $100,000 per year in retirement. Nancy has already retired and Ben, 63, plans to retire at 67. He is saving $20,000/year for retirement. Let’s assume they both live to age 95. If Ben indeed retires at 67, based upon certain expected market returns, there’s a 75% chance of retirement success for the couple (i.e. a financially secure retirement).

However, should Ben decide to retire earlier than 67, the chances for a successful retirement decline rapidly. If he retires at age 66, the couple has a 64% chance of success. If Ben retires at 65, the rate falls to 50% (a one-third drop from retiring at 67). That’s a dramatic difference, and it is not an impossible scenario, as the research shows.

Since many retire earlier than expected, it is equally important to consider if your goals are realistic. Consider an emergency fund to accommodate extenuating circumstances, such as your health, that may prevent you from working as long as you plan. Now, back to work!

Philip Mock

Vice President

(918) 744-0553

pmock@trustok.com