The New Tax Law & the Economics of Divorce

The Tax Cuts and Job Act of 2017 (TCJA) changed various tax laws related to divorce. These changes could affect the way you approach a possible divorce settlement as well as impact your financial planning.

Prior to the TCJA, alimony was treated as taxable income to the recipient. It was also tax-deductible to the payor. This tax regime had been in place for over 70 years. For some high net worth parties contemplating divorce, the deductibility of alimony payments previously had the chance to influence the amount paid to the potential former spouse. Under the new new law, alimony is now tax-free to recipients and no longer deductible for the paying spouse for divorces in 2019 and forward.

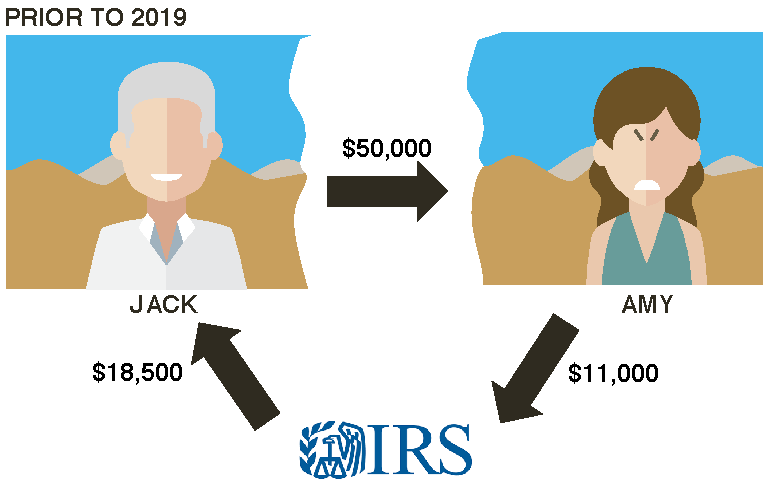

For an example, see the graphic below. Jack and Amy are getting a divorce. Under their agreement, Jack will pay Amy alimony totaling $50,000 a year. After the divorce, Jack will be in the 37% tax bracket and Amy in the 22% tax bracket. If they divorced prior to 2019, Jack’s $50,000 payment to Amy would be tax deductible and would reduce his taxes by $18,500 ($50,000 X 37%), so his net cost would be $31,500. However, the payment would have been taxable to Amy, costing her $11,000 ($50,000 X 22%), so the net she received was $39,000. As a unit, they gained $7,500 in tax savings by shifting the taxable alimony income to Amy, who is in a lower tax bracket than Jack.

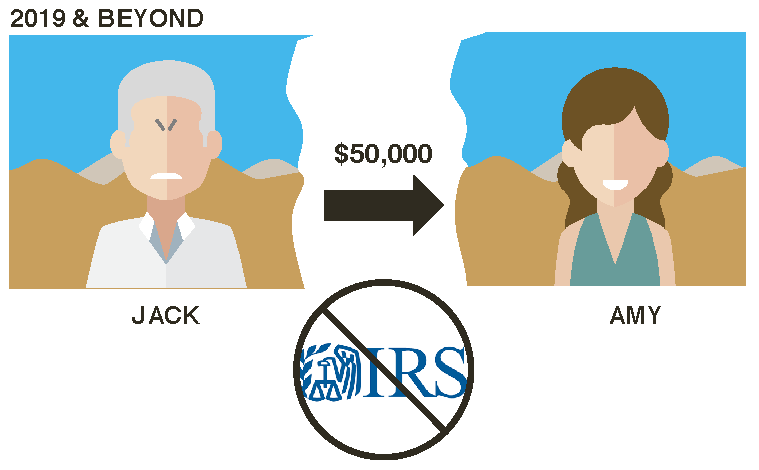

If they divorce in 2019, Jack loses his $18,500 tax deduction, but Amy no longer pays $11,000 tax on the $50,000 received. The alimony payment is a direct shift of $50,000 from Jack to Amy. With no tax benefit, Jack may be less inclined to agree to a $50,000 alimony payment (see below).

One negative aspect for the receiving spouse, due to the tax-free nature of alimony, is that it can no longer be used to fund either a traditional or a Roth IRA.

Ignoring tax implications in estate planning could make a divorce an even more expensive endeavor, so make sure to talk with your estate planning professionals and tax advisors before starting negotiations with your future ex.