The Winding Road to Recovery

By Nick Gallus

Only halfway through the year, 2020 is already historic by several measures. This includes the first global pandemic since 1918-19, a faster stock market downturn than October 1929 (which kicked off the Great Depression), and protests in hundreds of American cities echoing those of the late 1960s. On the Main Street economic front, tens of millions of American workers have lost their jobs or been furloughed, there has been a sharp contraction in economic activity, and oil traded below zero for the first time ever.

The U.S. officially entered a recession in February as the pandemic swept across the country and lock-down measures went into effect. Yet, here we are just four months later and the stock market has recovered much of its losses. While many media headlines point out the current market “disconnect” between the Main street economic damage and strong stock market recovery, at Trust Company of Oklahoma we believe that this market recovery is similar to others in the past and signals that the U.S. economy is expected to begin growing again later this year.

The risk remains of another wave of Covid-19 infections, unexpected delays in the production of an effective vaccine, or perhaps a double-dip recession, but absent those events, we are confident that a new economic expansion and bull market is on the horizon given the depths of the current downturn.

Strong Stock Market Gains Signal Economic Recovery

Before considering some interesting economic data, it is instructive to know that there’s good reason why the stock market is often called a “discounting mechanism.” Investing is inherently based on future expectations, with a good rule of thumb that the market leads the economy by three to six months.

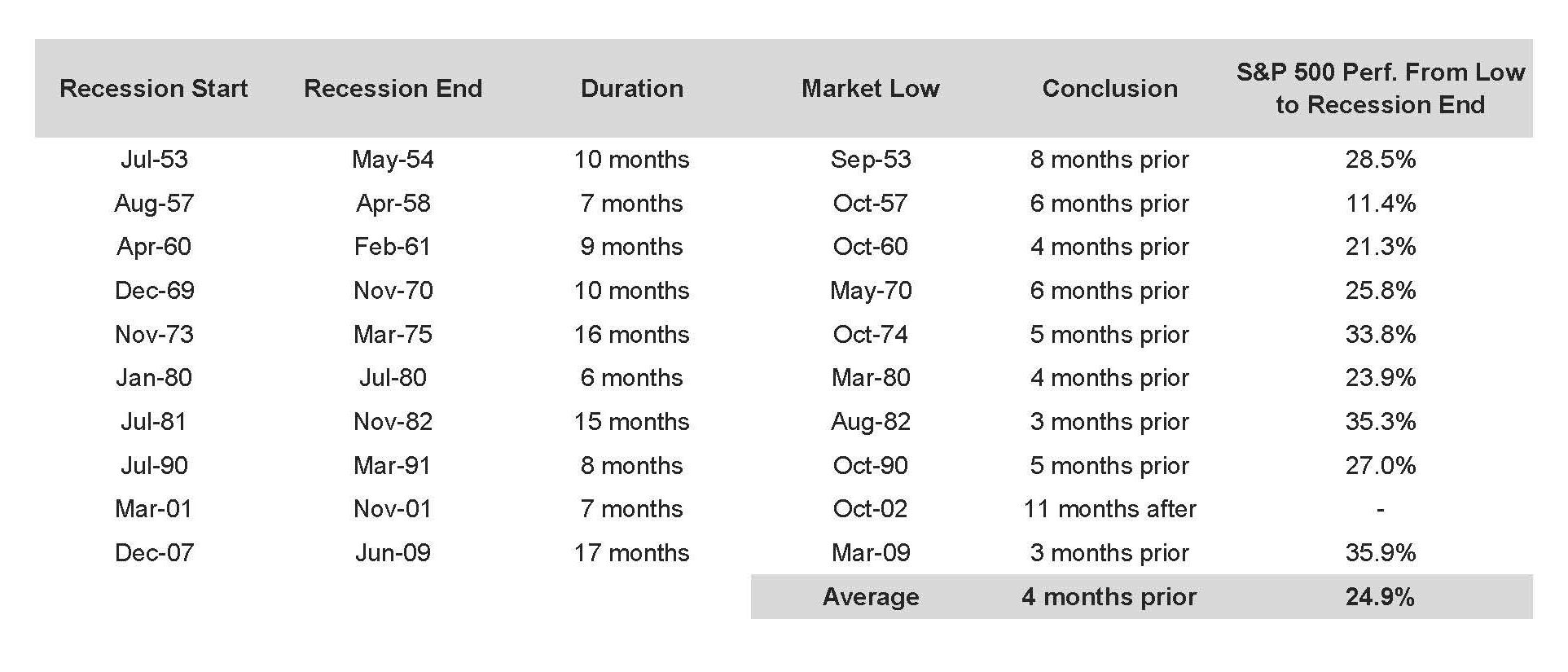

According to the analysis on the following page, showing the last 10 recessions going back to the 1950s, the average recession lasts about 10 months. Perhaps remarkably, the stock market has hit bottom four months before, then rallied 25% by the end of a recession on average (see chart below). Making matters difficult for investors, one never knows beforehand when a recession will end, so timing this bounce is nearly impossible.

Economic Recessions vs. Market Lows

SOURCE: STRATEGAS

To put this 25% “recovery bounce” in perspective, consider that U.S. large-cap stocks (i.e. S&P 500 index) have returned on average 9.8% compounded annually from 1925 through 2019, according to the Center for Research in Security Prices (CRSP).

In other words, coming out of the depths of a recession, the market typically recovers about 2 ½ years’ worth of gains in the span of just four months! This is why market timing is so dangerous, particularly around economic cycles, and we recommend that investors stay the course through market downturns.

2020 Recession in Perspective

Relating these historical figures to 2020, the S&P 500 hit a closing low of 2,237 on March 23 and was up more than 25% to above 2,800 by April 14, just 15 trading days later! True to historical precedent, it appears that the stock market rebounded before the U.S. economy hit a low point in terms of economic contraction in the second half of April. With the benefit of hindsight, it appears that the 2020 recession could be one of the shortest, at two to three months long, but one of the most severe recessions in history.

Real-Time Economic Data

Due to the increasing digitization of the world, there are several interesting statistics available to measure, in real-time, the pace of economic recovery. This includes monthly and weekly credit and debit card spending data from Visa and Mastercard (which process trillions of dollars in consumer transactions annually), weekly unemployment claims, TSA airline passenger check counts, travel statistics from Apple maps, and OpenTable restaurant seating, among others. All these data points indicate the same conclusion – the U.S. economy likely hit its lowest point in mid-to-late April.

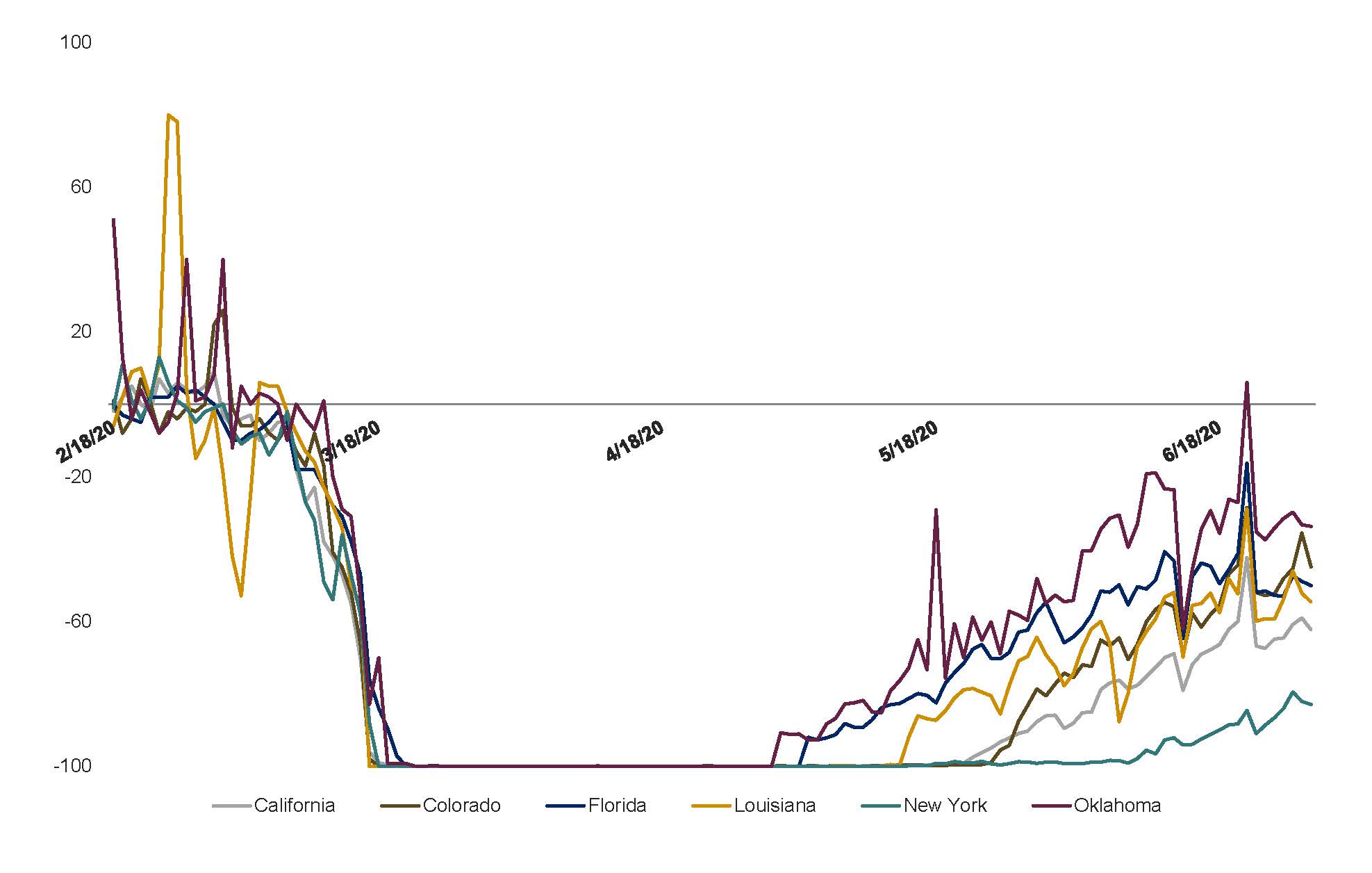

One of the most interesting statistics among these has been the OpenTable restaurant seating data. There are shortfalls in the consistency and completeness of this data, but OpenTable also displays data by state and city, which is insightful (see

chart below). When the pandemic first started impacting our economy in late February, a drop-off in seated restaurant diners was one of the first indicators that trouble was brewing.

Seated Diners From Reservations (In Percentage)

SOURCE: OPENTABLE

SOURCE: OPENTABLE

Resilience Is an Important Feature of the U.S. Economy

While the economy is on the mend from a sharp contraction, the path of recovery is uncertain, given increasing spread as the economy re-opens. We do not know how the coronavirus will present itself through the summer and in the fall/winter, and what additional preventative health measures will be necessary.

However, we can say this: we are all, both personally and institutionally, much better prepared for other waves of this virus than we were this past spring. Individuals, companies, local governments, and the health care system all know better how to respond if we encounter another round of community spread. This should give everyone confidence that the economy should continue to recover.

Economically, we do have concerns about the potential long-term negative implications of both excessive bond purchases by the Federal Reserve (dropping interest rates to extremely low levels) as well as fiscal stimulus that together have totaled over $6 trillion. However, in the short-term, the verdict is that both were done with unprecedented speed in order to get resources into the hands of people and businesses in short order, helping blunt the economic impact of the lockdowns and prevent the economy from spiraling into a depression.

Dynamic Shifts

While some industries, including hospitality, tourism, and other leisure activities are being particularly hard hit, it is important to recognize that the pandemic will be stimulative to many other industries, including pharmaceuticals and biotechnology, cloud and super-computing, e-commerce and delivery services, communications/media, and gaming.

These shifts currently underway may have long-term implications in terms of how income is distributed throughout the country and which sectors of the stock market grow faster or slower going forward. Each crisis sows the seeds of the next recovery, and our dynamic economy shifts in response.

After the 2008 Global Financial Crisis, the U.S. banking system shifted from one of irresponsible risk-taking to one of stability and resilience, which has helped weather the economy during the pandemic – by quickly distributing Payroll Protection Program loans, for example.

Won’t Be Caught Flat-Footed Again

In the past, the Federal Government has responded to real or anticipated threats to the country by building institutions that bring more stability in the future. For example, the Department of Homeland Security was created in response to the 9/11 attacks to prevent terrorist attacks. Similarly, today the important work being done by the Department of Health and Human Services, Centers for Disease Control, Biomedical Advanced Research Development Agency, and other institutions to better prepare for future virus outbreaks hopefully means we won’t be caught flat-footed by another pandemic.

Pandemic Was a Turning Point

Looking back in history, big monumental events tend to be turning points, and almost no one alive today has experienced anything similar to the pandemic of 2020. We are confident that the wheels are in motion to build a more robust and quickly-responding healthcare system and that the shifts currently happening within the economy will ultimately lead to a new, higher economic and market cycle.

Nick Gallus, CFA

Senior Vice President

(918) 744-0553

NGallus@TrustOk.com