Trying Not To Be a Dodo

By Robert A. McCormick

In the 17th century, the last dodo bird perished. This extinct bird is believed to have been exterminated by humans introducing animal species to its island home. The dodo is occasionally invoked as a symbol of obsolescence in the path of progress. Fiscal conservatives may want to brush up on the history of the dodo: a bird with wings that evolved into flightless prey.

Dodo engraving from a French textbook, 1887

Entering the 2020 presidential election, the candidates’ positions regarding deficit spending seem to be coalescing around one of two options:

a. Wring all available hands. Then continue to spend and run up the federal debt to increasingly higher record levels. No serious efforts to rein in debt by addressing the primary driver: mandatory entitlement spending. Raising taxes is not a priority either.

b. No need to wring any hands. Enthusiastically, spend and borrow more – a lot more. Except for more taxes on the “rich,” the absence of higher taxes shouldn’t be an impediment to increased spending on additional programs.

The political landscape has shifted to a populist stance, increasing the probability that the sea of red ink will get deeper, with less pushback from the rarely spotted fiscal conservative.

The big question for investors is what this shift might do to the markets. This discussion is about what I think is happening and will happen, not what I think should happen. Let’s first explore why the shift is happening.

Everyone Asks Why

Not Your Parents’ Standard of Living: It’s been harder for members of the newer generations to be better off than previous ones. Household income and wealth have become much more unevenly distributed due to a variety of hurdles to upward mobility, including healthcare, education and technology. Non-economic measures of advancement such as the recent drop in life expectancy signals a much rougher life for a significant segment of society. People are looking to the government for added help. A populist message is resonating with both the left and the right.

The Fed’s Hammer: Since 2007, economic growth has slowed dramatically. The Fed’s attempts to goose the economy by inflating asset prices is not a bug but a feature of its low interest rate strategy. The Fed’s efforts have directly benefited investors and borrowers, but not nearly as much for all others. The resulting frustration is one reason more aggressive proposals are developing for the government to borrow and spend more.

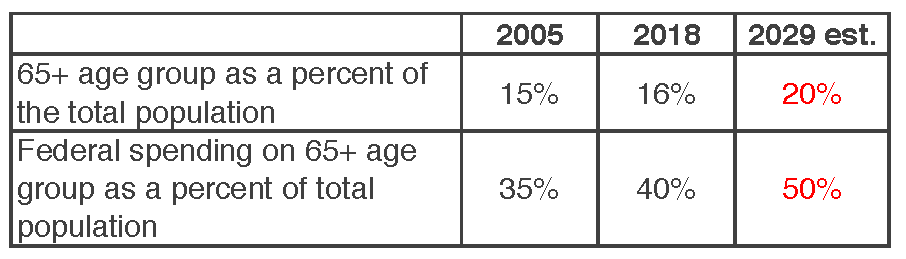

Demographics: The Congressional Budget Office (CBO) data shows our society continues to age as the percentage of the population who are 65 and older steadily climbs.

The CBO data also forecasts that in 10 years, 50 cents of every federal dollar spent (excluding interest on debt) will go to senior citizens, primarily in the form of Social Security and Medicare, even though they will comprise only 20% of the population. The other 50 cents will be spent on everyone and everything else – programs that directly benefit the under-65 age group plus defense and infrastructure, national parks and the National Institutes of Health, Homeland Security and environmental protection. Et cetera.

A younger person doesn’t have to be a rocket scientist to understand the implications this current trajectory has on their future.

Markets Curb Emotions

If fiscal discipline in D.C. wanes further, financial markets will be expected to exercise more restraint over politicians with the checkbook as the voting public will not likely vote for a spending cut or higher taxes. Politicians and markets have historically gone together like wayward children and disciplinarians.

However, investors expecting the markets to push back on government largesse could grow impatient, like waiting for the parent to rein in the little hellion in the restaurant. Discipline may eventually ensue, but by then you will have lost your appetite. I think the markets are likely to look through the new spending proposals and not panic, at least not for the time being.

This Time Is Different: Dangerous words, I know. But markets are looking for actions that boost growth and broaden benefits to more of the population, not balance the budget. Current monetary tools to boost growth have not worked as well as intended. Since inflation remains subdued, there seems to be a growing willingness to take more aggressive actions. If this does not appear obvious right now, it will in the next recession when there are even louder pleas for government assistance.

It’s Relative: If you are having angst over our economy or demographics, take a look at most of Europe and Japan to feel better. We are the cleanest dirty shirt in a world of heavily soiled economies. Most developed countries would love to have our 2% growth. Investors recognize this and have rewarded our equity markets more than most other countries. (Caveat: bad economies can produce good stock returns and vice versa.)

Our markets have allowed our politicians to be less concerned about our fiscal situation. Unlike earlier times, there is little market pressure to become more fiscally conservative at the moment – no drop in stock prices nor rise in interest rates nor fleeing the U.S. dollar due to our deficit spending. Back in the early 90s, the Clinton Administration was punished by the bond market with higher interest rates due to concerns about deficit spending. There are no “bond vigilantes” riding the circuit these days.

Even Ugly Ain’t All Bad: A word that is supposed to instill fear in the U.S. is “Japanification.” This word describes: an economy with minimal growth in spite of higher deficit spending; deficit spending generating a mountain of debt that will never get repaid; a central bank buying all types of assets that will be hard to sell; interest rates that are negative; structural deflation that remains a constant battle; and demographics disaster because the population is shrinking.

This all sounds really bad. But the country’s debt is still rated investment grade and over the past 10 years, Japan’s Nikkei Index has returned 10% per year in Yen. That’s pretty good for a country that is supposed to be the bad example to avoid at all costs. And amazingly, some are using Japan as the model for how aggressive a country can be when it comes to borrowing and spending.

King Dollar: The U.S. possesses the most powerful economic tool (and weapon) ever invented: the U.S. dollar. You and I use it every day without giving it a second thought. But so does the majority of the world. Most international trade is in dollars. It is also the dominant reserve currency held by other countries’ central banks, with a market share of over 60%. Like our Navy, the dollar projects power and control around the world. We trade in dollars. We borrow in dollars. We pay our expenses and repay our debts in dollars. And we write the rules for any country, company or individual who wants to do the same. There are some clouds on the horizon, but for now, the greenback reigns supreme.

Checks and Balances: Last but not least, our form of government is not built for sharp turns. Radical changes usually only come when in a crisis or when one party rules the roost and isn’t concerned about governing nearer the center. While deficits will grow regardless of who is in charge, some of the more outrageously expensive spending proposals (see below) have little chance of becoming reality as long as both political parties exercise power.

“Blessed are the young,

for they shall inherit

the national debt.”

Economists Make Assumptions

A relatively obscure (until now) economic theory termed Modern Monetary Theory (MMT) states that our currency power allows us to borrow and spend whatever we want as long as inflation does not rise too much. No need to worry about an ocean of red ink since we repay all creditors, foreign and domestic, with U.S. dollars. Have the Federal Reserve simply click a few buttons to credit the U.S. Treasury with cash so it can write checks, big and small, to those in need. According to MMT, much of the conventional economic theory we’ve been operating under for 80+ years is just plain wrong.

Thanks in part to MMT, we are now witnessing proposals that seek to make the spending pie bigger than one might think fiscally prudent or even possible under current law. These plans include a push for free college tuition, student loan forgiveness, a guaranteed job, a guaranteed basic income, Medicare for all and the New Green Deal. Note how most, if not all, are focused on the under-65 population. This fact alone suggests a change in the debate regarding the level of government spending.

There is no way to realistically pay for most of these new initiatives, even with tax increases. (But then again, there is no easy way to pay for the $22 trillion of obligations we have already incurred.) Fortunately, MMT says we don’t have to… unless and until inflation gets out of control. MMT is gaining traction, especially on the left. A new era of government spending may soon be upon us, absent market chastisement.

Investors Stay Disciplined

Investors have always had to adjust to new economic eras, and the future will be no exception. But for now, there appears to be little signaling from the markets that our country is falling into the financial abyss. Unless and until there are stronger market signals, investors should not let their investment strategy jump too far ahead in anticipation of a massive change in government’s role in the economy. It’s okay to be nostalgic for the (brief) days of fiscal conservatism, but don’t let your politics drive your investment decisions. That’s good for all of us to remember as we head into the 2020 election festivities.