Two Rules To Live By – Bob’s Market Observations

Folks,

- Stay out of the courthouse

- Stay out of the hospital

Both of these declarations are regular instructions to myself, reminding me to avoid stupid decisions. Fortunately, these rules are easy to remember. And they aren’t complicated, so I have a decent chance of success. Most of the time. Plus, adherence to both allows so many other things in life to take care of themselves.

The rules are also aspirational since I obviously don’t have complete control over life. When one gets broken, it doesn’t take long to put life’s regular bumps into proper perspective. A fact that is truly appreciated only after one of these rules gets broken.

Such as what happens to a middle-aged body when its owner climbs on top of the roof to trim the nearby trees. Operating a pole chainsaw thirty feet up. What could possibly go wrong? Let’s just say I eventually visited the hospital for repairs… followed by lots of therapy. It was the most expensive tree trimming job ever.

I realize both the institutions named in my rules are very important to society and do tremendous good. But life’s better most days when you don’t need the services contained behind either of their doors. Marriage licenses and babies are but two obvious exceptions.

My colleague Brittney reminds me of a third rule I have: stay out of casinos. I don’t lump casinos into the same “societal good” group with hospitals and courthouses though. I understand they are places of entertainment with attractions such as restaurants, bars and concerts. But the odds are pretty high that nothing good is going to happen to me inside one. The weight of that building ultimately falls hard on too many of its visitors.

I figure if you can minimize your attendance in these three establishments, you have a much better chance of having a less stressful life. And a more financially secure retirement.

What doorways do you try to avoid?

Cheers,

Bob

“Mere access to the courthouse doors does not by itself assure a proper functioning of the adversary process.”

– Thurgood Marshall

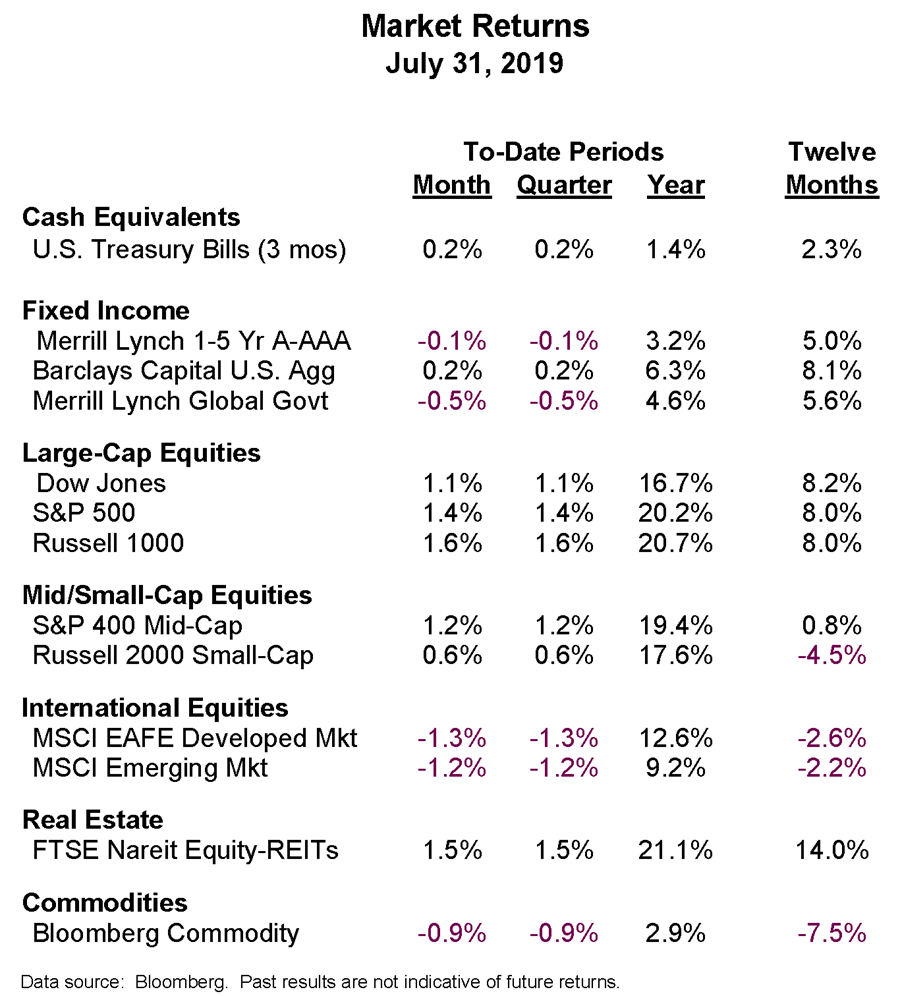

Market Returns

The Fed lowered short-term interest rates by one-quarter percent (1/4%) the last day of July. While this move was favored (and much anticipated) by most investors, Fed Chairman Powell signaled in his press conference that additional rate cuts may not materialize as quickly as markets desire. The Dow fell over 300 points that afternoon in response. Markets are adjusting to a Fed that is somewhere between dovish and hawkish. Exactly where remains to be seen, but it seems clear the Fed will move cautiously before any further rate changes.

U.S. stocks still had a respectable month, with the S&P returning 1.4%. This puts its year-to-date return at 20% – a fantastic number. International stocks lost ground in July.

While the Fed lowered short-term rates, certain other rates rose a smidgen during the month. This resulted in slightly negative to modestly positive fixed income returns for July. Year-to-date bond returns are good though, due to interest rates dropping in the first half of 2019.

Robert A. McCormick

Senior Executive Vice President and COO

(918) 744-0553

Bob.McCormick@TrustOk.com