Understanding Your 1099 Form

When looking at your 1099-B tax form, which reports your capital gains/losses from securities sold during the tax year, have you ever wondered what the difference is between covered and noncovered sales? If so, you are not alone. Questions regarding these classifications, and how they are reported on the 1099-B tax form, are among the most common questions we receive from clients each tax year.

When you file your tax return, you report your adjusted cost basis (the original value or purchase price of an asset for tax purposes) on Form 1040, Schedule D for all securities you sold during the tax year. Originally, the IRS relied solely on taxpayers self-reporting their cost basis. However, that changed in 2011 when new legislation required financial institutions to include cost basis information on Form 1099-B.

That legislation deemed securities purchased after certain dates to be “covered” by the new reporting requirement, while securities purchased before those dates remained “noncovered” by the new rules. Thus, the two categories seen on your 1099-B tax form were born. The determining purchase date depends on the type of security as seen below.

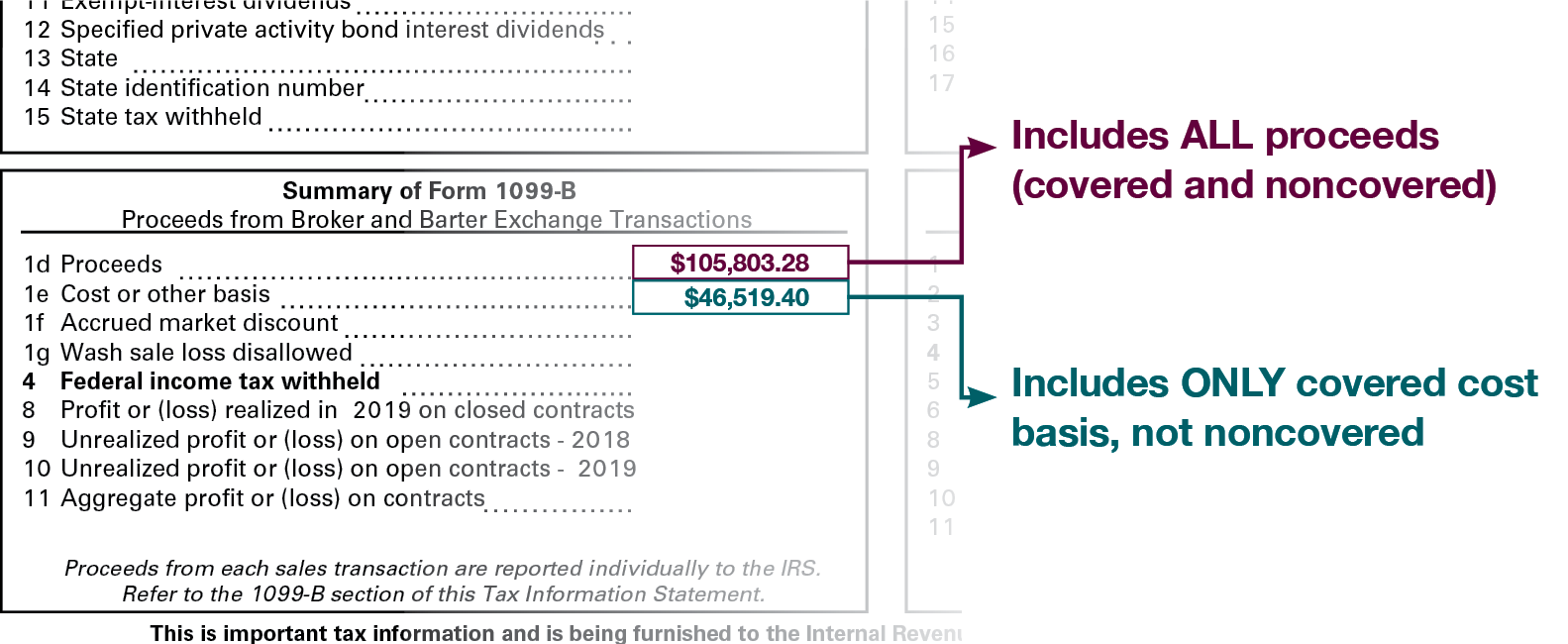

To further add to the confusion, in the Summary of Form 1099-B section (see breakout below), the IRS requires financial institutions to report ALL proceeds, for both covered and noncovered sales, on line 1d “Proceeds.” However, financial institutions are required to report the basis for covered securities ONLY on line 1e “Cost or other basis.” For this reason, you cannot rely solely on the summary section when preparing your tax return. Instead, you should examine the details on the pages immediately following the summary to locate your total cost basis for both covered and noncovered securities.

Equipped with that detailed information, you and your tax professional can confidently answer the covered or noncovered question.

BRI GHOSN, CPA, CFP®

Senior Vice President & Chief Financial Officer

(918) 744-0553

BGhosn@TrustOk.com